Uncategorized

Celebrate National Senior Health & Fitness Day: Stay Active, Stay Healthy!

Every year, on the last Wednesday in May, we celebrate National Senior Health & Fitness Day—a special occasion dedicated to the health and well-being of our senior community. This day serves as a reminder of the importance of staying active and healthy as we age. Medicare Advantage Plans: Covering Fitness Expenses Many seniors might not be aware that some Medicare

Navigating Medicare Open Enrollment: Your Guide to Making Informed Choices

Medicare is a lifeline for millions of Americans, providing essential healthcare coverage to seniors and those with certain disabilities. Every year, during the Medicare Open Enrollment period, beneficiaries have the opportunity to review and make changes to their coverage. It’s a critical window for making informed choices that can impact your healthcare and financial well-being. In this blog post, we’ll

Medicare Q&A – Ask A Nerd at Broadway Commons – Salem, OR

Learn about your Medicare options and how to compare plans. On 6/23/23, Lisa Bilgen de Herrera will be in Salem, OR answering questions about Medicare, including how to sign up, and your coverage options. If you’re ready to shop for Medicare plans, we’ve got you covered! When? June 23rd, 2023 Where? Broadway Commons 1300 Broadway Street NE Salem, OR 97301 United What Time? 12:00

Federally Mandated Health Insurance Special Enrollment Period (SEP) Extended Through August 15th, 2021

Did you miss the Annual Open Enrollment Period? In March, President Biden announced that the Centers for Medicare & Medicaid Services (CMS) is extending access to the federally mandated Special Enrollment Period (SEP) through August 15. This gives you extra time to take advantage of new savings through the American Rescue Plan Act (ARPA). ARPA allows individual/family enrollees an additional

Open Enrollment Has Arrived – Why Work With an Oregon Health Insurance Broker

Open Enrollment has arrived (Nov. 1 to Dec. 15). This is the time of year when you’re allowed to start, stop or change your health insurance plan. Getting health insurance coverage in Oregon doesn’t have to be confusing and expensive. Working with a licensed Oregon broker to get individual health insurance is extremely valuable. What do health insurance brokers in

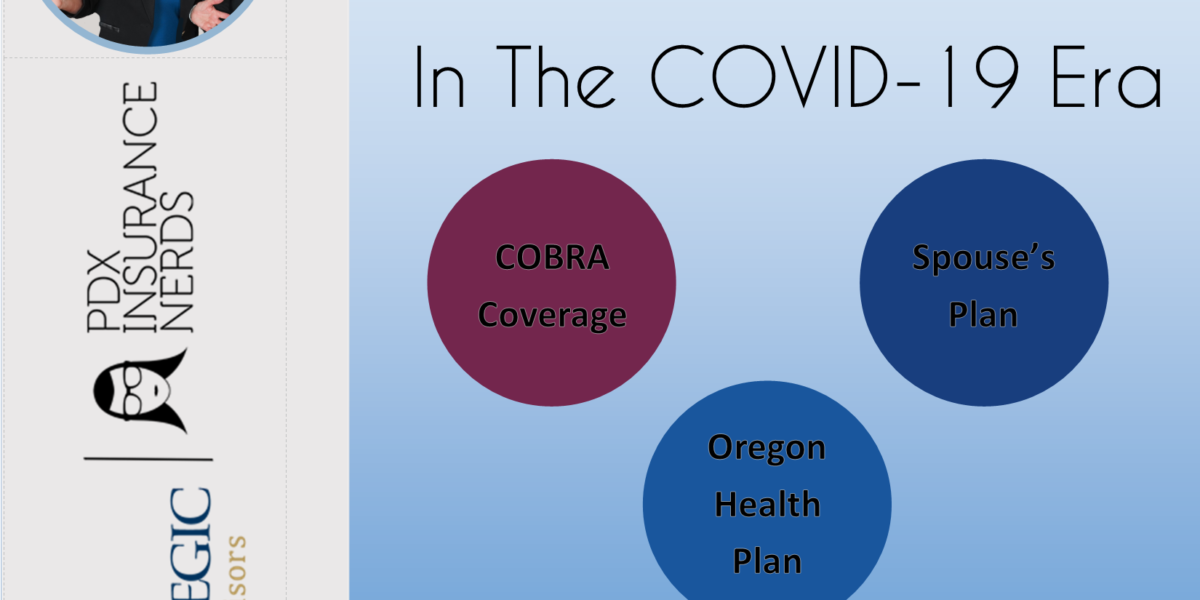

Health Insurance After Job Loss in the COVID-19 Era

Over the past several weeks nearly 500,000 Oregonians have filed for unemployment. Many Oregon workers gets their Health Insurance form their employer, this means there are thousands on newly uninsured Oregonians. If you find yourself in this situation, what are your options? Act now as you only have a 60 day Special Enrollment Period (SEP) to enroll in new coverage.

It’s Not Too Late to Purchase Individual or Family Vision Insurance

Protecting your eyes starts with routine eye exams. Because many eye and vision conditions exhibit no obvious symptoms, individuals are often unaware that there is a problem. Early diagnosis and treatment of eye disorders such as cataracts, glaucoma and macular degeneration are important for maintaining good vision and preventing permanent vision loss. Eye exams are an important part of routine

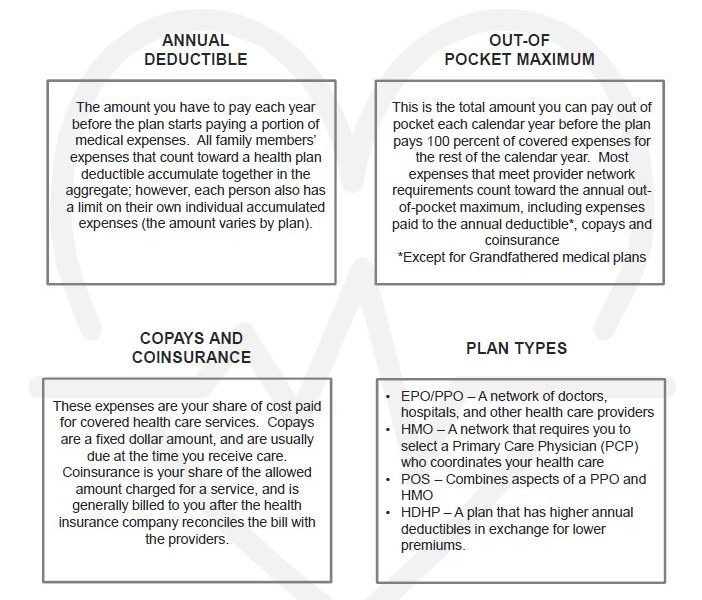

Understanding Oregon Health Insurance – Key Terms to Remember

Key Terms to Remember ANNUAL DEDUCTIBLE The amount you have to pay each year before the plan starts paying a portion of medical expenses. All family members’ expenses that count toward a health plan deductible accumulate together in the aggregate; however, each person also has a limit on their own individual accumulated expenses (the amount varies by plan). OUT-OF POCKET

The Benefit of Benefits – Why Oregon Employers Should Offer Health Insurance Benefits

As an Oregon employer, remaining competitive in the hunt for the right job candidates who will propel your business to success is a struggle. Once you find the people you need, you have to convince them that your company is a better place to work than your competitors. A strategic, quality employee benefits package can help you attract and retain

Term Life Insurance in Oregon & How Much to Buy

Term Life Insurance is designed to offer financial coverage to help your family pay off your outstanding debts, meet your ongoing financial obligations, and cover your final expenses. Your life insurance benefit can also be used to replace your income and help your loved ones continue to pay everyday expenses like rent/mortgage, groceries, and so on. Life insurance isn’t a